Many employers are using total compensation statements, also known as employee benefit statements, to help employees understand the value of their pay and benefits package. An effective total compensation statement increases employee retention, promotes company culture, and increases job satisfaction.

Table of Contents

- What is a total compensation statement?

- The difference between total compensation statements and employee benefit statements

- Why should you use a total compensation statement?

- What does a total compensation statement include?

- Five best in class total compensation statements

- Conclusion

- FAQs

What is a total compensation statement?

A total compensation statement is a document that shows an employee’s breakdown of total pay, benefits, and rewards for the year. Although this may sound like a pay stub, it is not. Employee benefit statements provide an itemized and detailed overview of the investment an employer makes in their employees. When an employee sees the total investment, they feel valued by their employer.

The difference between total compensation statements and employee benefit statements

There is very little difference between a total compensation statement and an employee benefit statement. HR professionals often use these two terms synonymously, however, there are some very minor differences between the two.

- Total Compensation Statements: A total compensation statement is a document that provides an overview of all the monetary and non-monetary benefits an employee receives from their employer. These can include not only salary but also bonuses, paid time off, healthcare benefits, retirement plans, and other perks like gym memberships or continuing education opportunities.

- Employee Benefit Statements: An employee benefit statement is a financial breakdown that illustrates the cost and value of the benefits an employee receives from their employer. While not as comprehensive as total compensation statements, it focuses primarily on healthcare, retirement, and insurance, giving a clear picture of the financial reward an employee receives in addition to their salary.

Both total compensation and employee benefit statements are powerful tools that can significantly improve employee understanding and appreciation of their total compensation package.

Why should you use a total compensation statement?

Employees need to feel valued more than ever as retention and recruitment has become exponentially more difficult for HR Managers. A recent Met Life study on Employee Benefits shows:

- Benefits constitute 30 percent to 40 percent of an employee’s total compensation package.

- 59% of employees do not fully understand their compensation and benefits program and wish their employer provided better communication about it.

- Employees who get communications from their employer about their benefits are twice as loyal to that employer.

What does a total compensation statement include?

A total compensation statement is a personalized document. Therefore, what is included in the statement will depend on the employee’s type of compensation they receive. Some examples of items that may be included in the statement are:

- Hourly/Salary Wages

- Medical, dental, and vision insurance

- 401(k) plan

- Paid leave for sickness, personal, vacation, etc.

- Health reimbursement arrangement

- Flexible spending accounts (healthcare, dependent care, limited purpose, commuter benefits)

- Employee assistance program

- Tuition assistance

- Adoption assistance

- Disability insurance

- Life insurance

- Stock options

- Bonuses

- Relocation assistance

- Pet insurance

- Financial wellness programs

- Company vehicle

- And more…

The statements should be a clear, concise, eye-catching presentation of employee benefits, fully customized to match your company’s brand and culture, with detailed personalization to each employee. Employers should also offer both print and digital delivery options.

The best way to understand the value of these documents though, is to see them for yourself. We’ve provided five best in class samples of what an effective statement should look like.

Five best in class total compensation statements

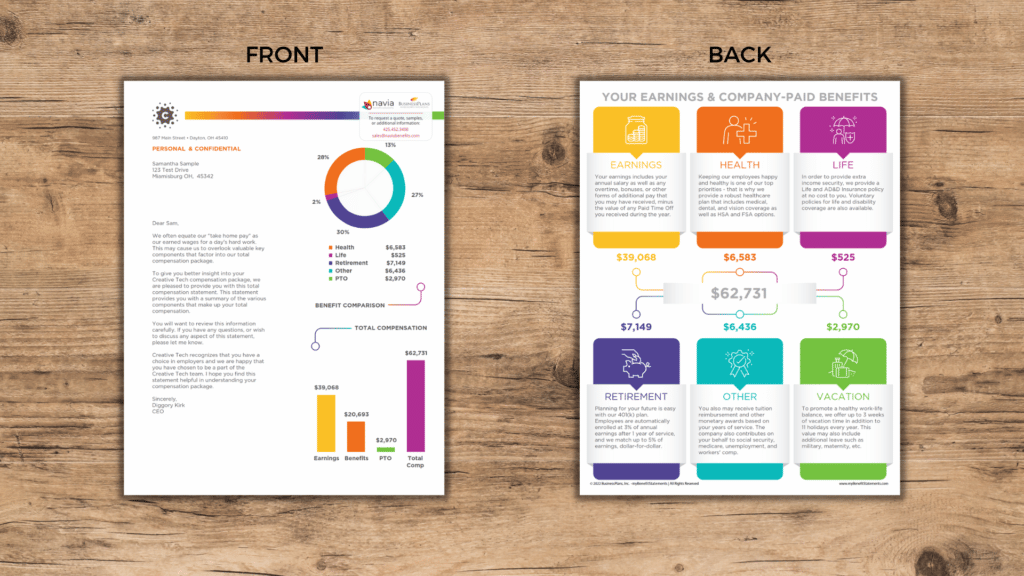

Creative Tech sample

Graphic and bold color forward

The Creative Tech design is one of the most popular choices for employers. It is a great example of how charts, bold colors, and icons bring attention to important stats and numbers. The colorful charts allow employees to see the distribution of their benefits at an easy glance. Each of the employee benefit categories has its own designated color, repeated throughout the statement. This makes it easy for the reader to identify the impact of each benefit.

A message from the company’s leadership team adorns the front of the statement and is a great way to build community, promote good will within the company, and describe the purpose of the document. On the back of the statement, up to six sections can be featured to show a short list of line items or a short description of the benefits. This flexibility allows for customization and brand to shine and fit the employer’s needs.

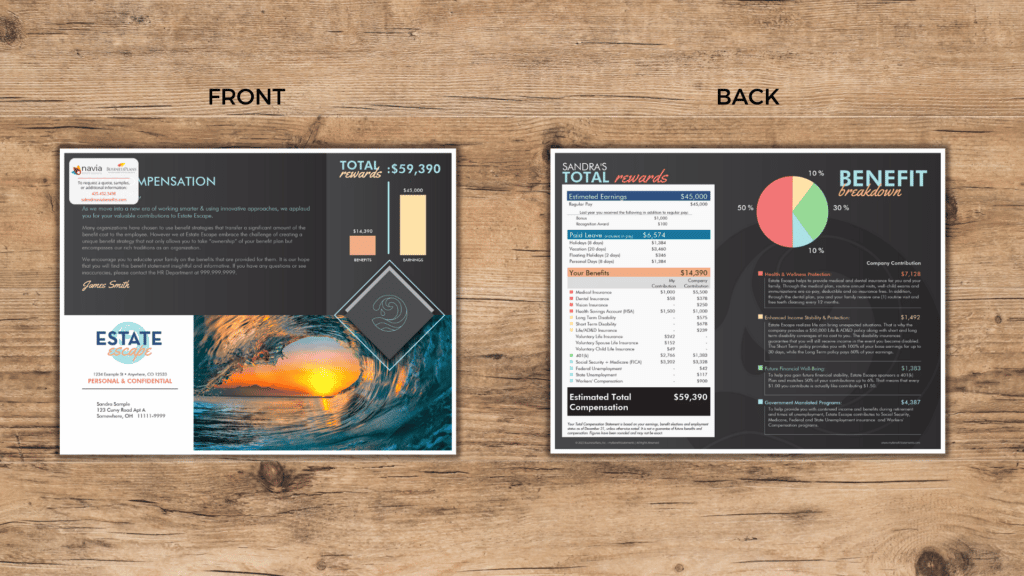

Estate Escape sample

Bold font and background

The differentiating factor in Estate Escape is the use of bold backgrounds and fonts. This design style helps bring the eye around the page while creating a modern, bold statement. The front of the statement provides a large area for a personalized message and branded graphic, driving company culture and the importance of total benefits. On the back, the benefits table is color coded making identification between each benefit easy. The table shows the distribution of company-paid benefits in a variety of categories with brief descriptions of each. Also included are bar and pie charts for a stunning visual graphic demonstration.

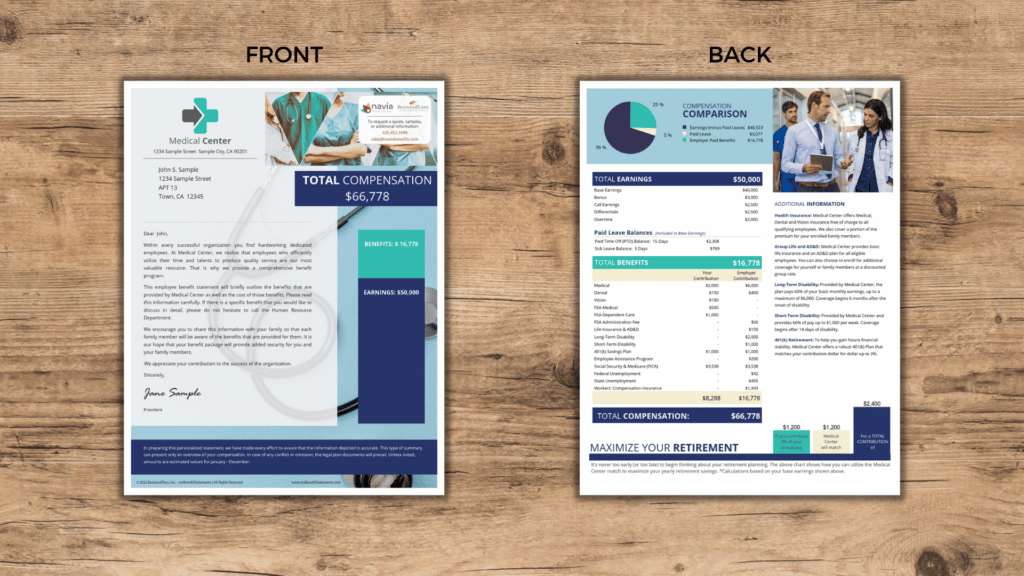

Medical Center sample

Chart-centric and sleek

The Medical Center example has sleek design, but still packs a lot of punch into a benefit statement. This sample allows for stacked bar charts that compare earnings to benefits and a table graph showing employee and employer contributions. Another popular feature of this sample is the pie and bar charts. In the above example, the retirement bar chart shows how employees can utilize an employer’s matching program to maximize their retirement savings.

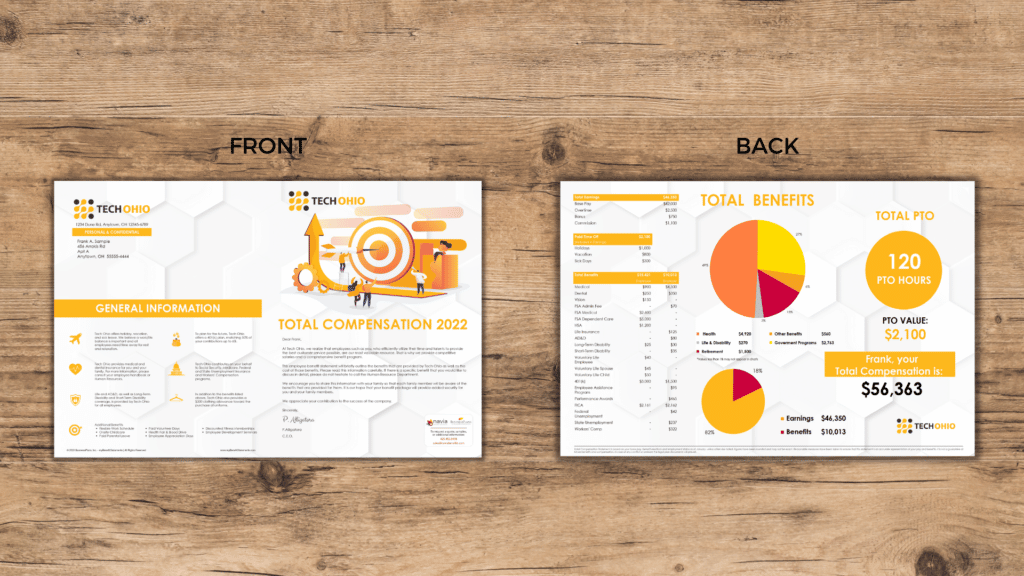

Tech Ohio sample

Compelling chart and graphics

The Tech Ohio sample is a 4-page format, printed on 11×17” premium stock and folded in half like a portfolio or brochure. The cover allows a full page to create a unique introduction that fits your brand image. Placing the letter from leadership on the front cover allows the entirety of the inner pages for displaying a total compensation table of line items along with several charts or graphic illustrations, helping employees visualize the data provided in their benefit statements.

In this example, two large pie charts illustrate the benefits and earnings distribution, and additional graphics highlight the value of PTO and the employee’s total compensation package.

The back side of the statement provides an opportunity of highlighting important information, such as benefit descriptions.

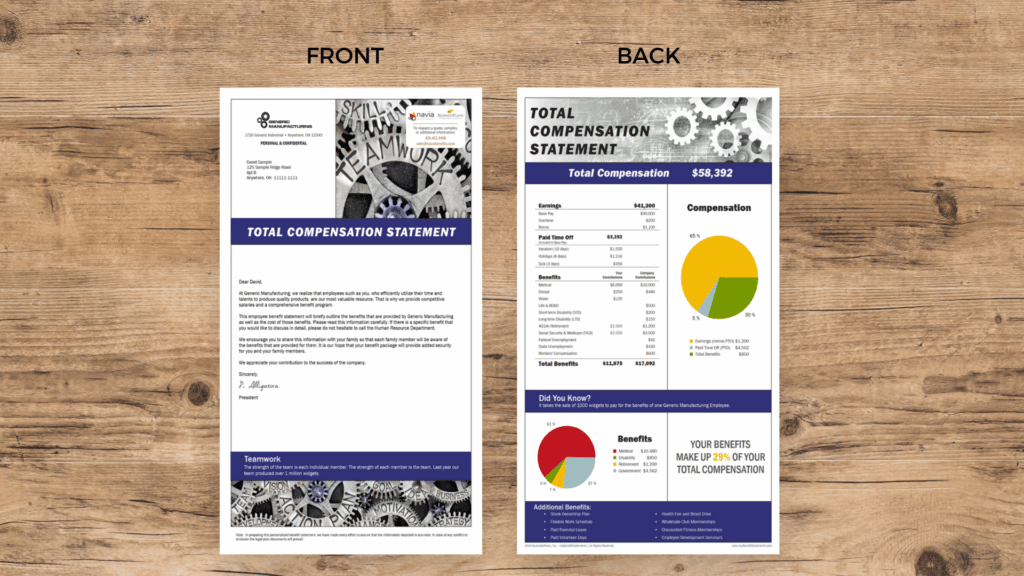

Generic Manufacturing sample

Extra space for more information

The Generic Manufacturing sample provides a lot of customizable space to work with. Since it is legal size (8-1/2 x 14”), employers have extra space to add more graphics and content than the regular letter sized statements. Using this extra space to include large images or graphics is a great way to show off company culture and brand. With the extra length, the addition of a “Did You Know?” section allows companies to show off stats or additional, non-monetary benefits. This statement features flexible callout or highlight areas, an itemized benefits table, compensation comparison, and benefit breakdown charts.

Build a beautiful total compensation statement for your company

Now that you have seen several top-notch examples of effective total compensation statements, it’s time to create your own. Working with Navia to build your tailored total compensation statement is simple and straightforward. Contact our sales team for more information – sales@naviabenefits.com.

FAQs

1. What is a total compensation statement?

A total compensation statement is a comprehensive document that shows the employee’s total pay, benefits, and work perks for a specific period. It is designed to provide an itemized and detailed overview of the employer’s investment in an employee beyond just salary.

2. How does a total compensation statement differ from an employee benefit statement?

While both documents serve to illustrate the employer’s investment, total compensation statements provide an overview of all monetary and non-monetary benefits an employee receives, including bonuses, paid time off, healthcare benefits, retirement plans and other perks. Employee Benefit Statements, on the other hand, are more focused on healthcare, retirement, and insurance benefits.

3. Why should employers use total compensation statements?

Total compensation statements help employers communicate the full value of the compensation package to their employees. Research shows that employees who understand their benefits are twice as loyal to their employers. These statements can increase employee retention, promote company culture, and improve job satisfaction.

4. What are some items that a total compensation statement might include?

Total compensation statements are personalized and can include a variety of items based on an employee’s compensation package. These items might include: hourly/salary wages, medical, dental, and vision insurance, 401(k) plan, paid leave, health reimbursement arrangement, flexible spending accounts, employee assistance program, tuition and adoption assistance, disability and life insurance, stock options, bonuses, relocation assistance, pet insurance, financial wellness programs, a company vehicle, and more.

5. How can I create a unique total compensation statement for my company?

Creating a unique and effective total compensation statement requires a clear, concise, and visually pleasing presentation of employee benefits that aligns with your company’s brand and culture. It should be personalized to each employee and can be delivered in both print and digital formats. Companies like Navia offer services to assist you in creating a statement tailored to your needs.