There are few benefits quite as impactful as a solid retirement program, and increasing participation in your company retirement program is a common goal for many employers. Not only is a solid retirement program an enticing benefit to employees, but it also contributes to the satisfaction and secruity of your staff. Employees want to know their employer cares about their financial well-being, and education is a great way to help them understand how you are securing their future.

Benefit statements are a great way to emphasize not only your overall benefits package, but the features of your retirement plan that will lead employees to a more successful savings plan. Here are 5 great ways to maximize your 401(k) plan for employees and show them the value of your contributions.

Make it Automatic

One of the biggest reasons that employees may not participate in a retirement program is because the process of enrollment is confusing. Auto-enrolling workers as they become eligible makes it easy for them to begin saving for retirement. An AARP survey found that 68% of U.S. employers are utilizing automatic enrollment. In addition, nearly 75% of companies who auto-enroll employees are also implementing automatic contribution escalation to help employees harness the power of inertia to save more for retirement. Many people plan to increase their contributions but never get around to it. Automatic escalation encourages greater deferral rates and gradually helps employees save more for their future.

Evaluate your match

Is your company currently offering a match for employee contributions? If not, consider adding one! Company matching can not only encourage participation, but also build company loyalty and reduce turnover. If you are already offering a company match, evaluate your policy – though many companies offer a dollar-for-dollar match, this may not be the most effective way to get participants to increase their retirement savings. Because most employees only defer the amount that they need to get their maximum matching contribution, a 50% match might be a better route to encourage higher contributions from workers. Consider this:

Company A matches 100% of contributions up to 3% of earnings.

Employee Salary: 50k x 3% = $1500

Employer Match: $1500

Total Contribution: $3000

Company B matches 50% of contributions up to 6% of earnings.

Employee Salary: 50k x 6% = $3000

Employer Match: $1500

Total Contribution: $4500

In both scenarios, the company contributes the same amount – however in the second example the employee ends up with an additional $1500 in retirement savings at the end of the year. By decreasing the match percentage to 50¢ per dollar, your employees actually save more over time.

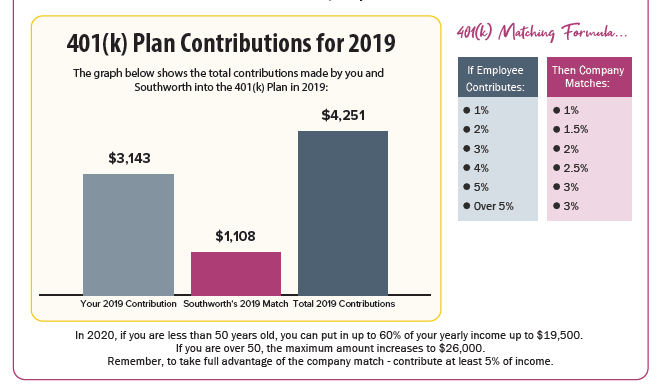

Emphasize deferral amounts

Make sure your employees know the rules! Each year the IRS sets the maximum amount a person can defer to their 401(k). By emphasizing the difference between what their current contribuion is and the maximum deferral, you can encourage employees to put more into their retirement savings. Also, make sure to educate employees who are 50 or older and eligible to make catch-up contributions! These additional monies can make a big difference as employees approach retirement age.

Show growth over time

One of the most enticing ways to encourage participation in a 401(k) is showing the potential of growth. Though projections are always estimated, and can fluctuate over time due to changes in elections and interest rates, this is still a compelling argument for early enrollment and continued participation. When employees enroll in a retirement plan early and contribute consistently, they take advantage of compounding interest that builds exponentially over their career.

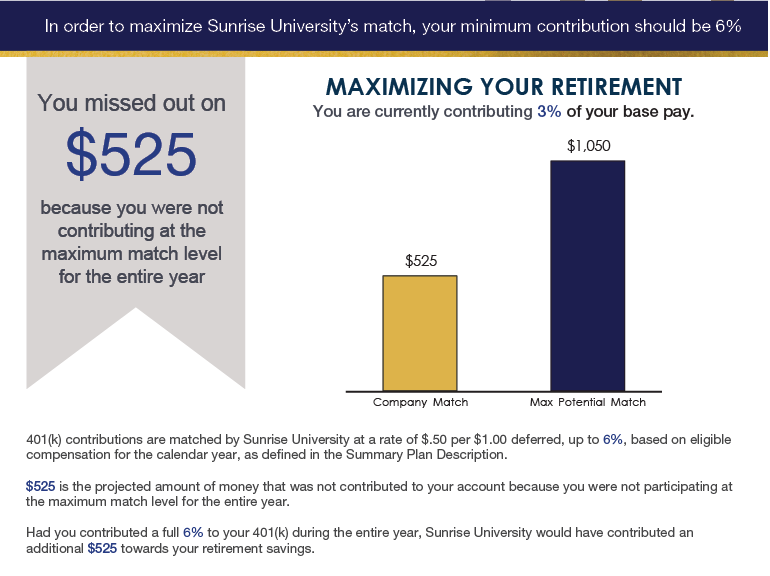

Highlight missed opportunities

No one likes to miss out! If your employees aren’t maximizing their opportunity to save, show them what they can do to increase their savings. By comparing their current match to the maximum possible match from your company, you can show employees where they could be earning more towards their retirement, or congratulate them for achieving their maximum match! It’s always a good time to evaluate your retirement offerings and how you can better serve your employees. Utilize your company benefits statements to communicate the full value of your 401(k) program and educate employees to maximize their yearly savings.

It’s always a good time to evaluate your retirement offerings and how you can better serve your employees. Utilize your company benefits statements to communicate the full value of your 401(k) program and educate employees to maximize their yearly savings. Contact us today to discuss how total compensation statements can help your company boost retirement participation!

Comments are closed.